Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

5 Mistakes to Avoid While Applying for a Gold Loan

Gold is considered a reliable asset in Indian households for the longest time. You might have observed during auspicious events, weddings, and festivals that people gift their loved ones gold in various forms. This is not only to pay respect to each in a regal manner but also to provide a financial asset to the future generation. Moreover, gold can be used in times of need or emergency. One of the most rewarding benefits of investing in gold is that it does not face devaluation like paper money. Hence, whenever the market crashes, the scope of gold’s value going significantly down is low. Due to this reason, people prefer investing their hard-earned money in gold as they will not have to face any losses.

When the need arises, you can take a loan against your gold jewellery with a suitable interest rate. This means that you can use gold items to take a loan to resolve an emergency situation. A lot of times, people get confused about the procedure involved in applying for a gold loan. Due to this reason, they end up making certain mistakes. Here are 5 of the most common blunders that you can avoid while applying for a gold loan:

1. Overlooking Prior Research

Before applying for a gold loan, it is important to know what it is all about. You cannot make a hasty decision while taking a loan of any kind. It is a significant financial decision that should be made after learning about its various aspects and key factors. From getting information on the interest rate offered on a gold loan to understanding what is the right way to repay it, you should know everything! There is so much information available online that you can become fully informed about the process of taking a gold loan within minutes. So, take out time some from your busy schedule and research gold loan.

2. Seeking Unauthorised Money Lenders

In earlier times, people preferred going to money lenders or sahukars in their area to get some sum of money on loan. This was only because they knew that these people lived in the same community, so trusting them was possible. In today’s times, it is better to get a gold loan processed at a reputed bank or non-banking financial company. The authenticity that comes with a trusted bank or financial institution is the main reason why you should consider applying for a gold loan from them.

3. Not Paying Attention to the Interest Rate

You might wonder, what exactly is the right interest rate on gold jewellery? Loans that are offered by renowned banks and financial firms on different jewellery items have interest rates that the borrower has to pay along with the premium within a set period of time. A lot of times, people with limited knowledge or experience begin the procedure of taking a gold loan without paying attention to the interest rate. This can become a big financial burden in the long run. So, it is recommended to choose a gold loan with a suitable interest rate that you will be able to afford.

4. Applying without Proper Documents

Whether you are applying for a gold loan for the first time or in the renewal process of a previous gold loan, it is important to keep your documents ready. While most reputed banks and non-banking financial companies do not ask for a lot of identification proofs, it is important to have at least one or two with you. Since their processing time is fairly quick and simple, only basic documents like address proof and one identity card are needed for getting a loan on your gold jewellery with a suitable interest rate.

5. Using Any Gold Item for a Loan

If you check out gold loan calculators on the internet on the official websites of well-trusted banks and financial companies, you will realise that not all gold jewellery items are eligible for getting a loan. So, if you visit a bank or a financial firm and try to apply for a gold loan with any jewellery item, it is not going to be fruitful for you. Thus, it is suggested to check which items can be used to get a gold loan and only then apply for one.

Now that you know what a gold loan is and how its application process works, Muthoot Finance would be the best non-banking financial company for you! Offering a range of financial services across the country, this organisation is trusted by millions of customers. Muthoot Finance believes in resolving all queries and concerns regarding the gold loan renewal process, claims on various policies, etc. at the earliest.

- Avail gold loan

- Calculate Gold Loan

- Check Gold rate today

- Gold Loan Eligibility

- Interest Rate

- Gold Loan Scheme

- Custom Offers

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Why Are Gold Loans the Best Option When Banks Reject Your Personal Loan?

Know More

Struggling with low CIBIL? Here’s How a Gold Loan Can Still Get You Funded

Know More

What is a Top-Up Loan? Eligibility Criteria Explained

Know More

Top Factors That Influence Mortgage Loan Interest Rates

Know More

What is a Loan Against Mutual Funds and How Does it Work?

Know More

What is Working Capital? Meaning, Formula & Importance

Know More

Understanding KDM Gold and Why it’s Banned

Know More

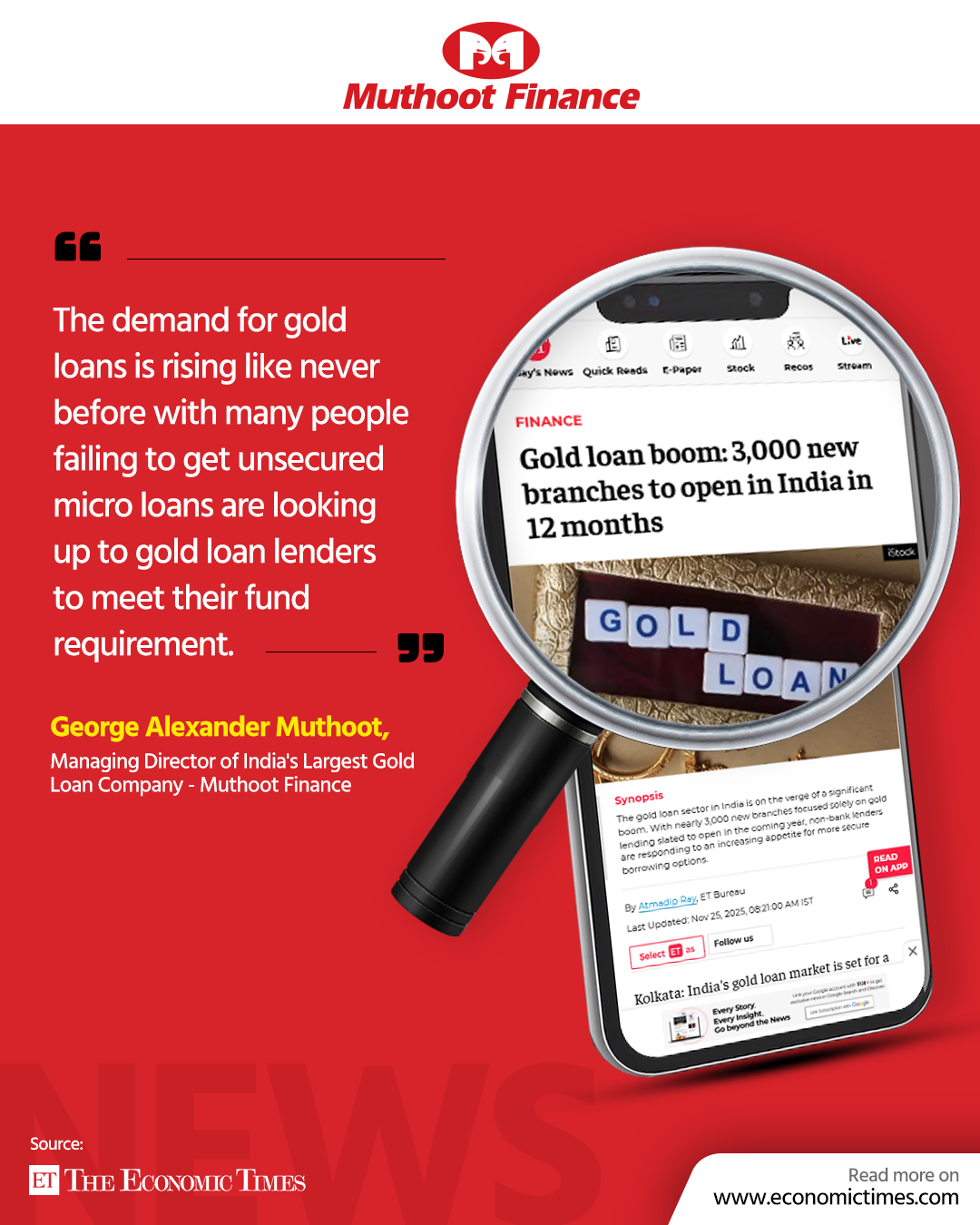

Gold loan boom: 3,000 new branches to open in India in 12 months

Know More

Gold Loan Boom: Rs 14.5 lakh crore market spurs NBFCs to add 3,000 branches

Know More

How BNPL Affects Your Credit Score

Know MoreFIN SHORTS

What Are Co-Pay and Deductibles in Insurance Policies?

Know More

Should You Take a Loan Against Your Mutual Fund or SIP?

Know More

Top 5 Best Mid-Cap Mutual Funds to Watch in 2026

Know More

Are Personal Loans Right for Retirees? Key Points to Consider

Know More

What Happens to a Personal Loan After the Borrower Dies?

Know More

Best Loan Choices for Credit Scores of 580 and Below

Know More

7 Reasons Why a Gold Loan Is the Best Option for Small Businesses

Know More

10 Reasons Why People in India Prefer Physical Gold

Know More

Real Estate vs Gold: Which Is a Better Investment in India?

Know More

10 Common Mistakes That Make Investors Lose Money in Mutual Funds

Know More

10 Reasons Why Gold Has So Much Appeal in Uncertain Times

Know More

7 Ways Settling Debt Can Impact Your CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212