Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Here’s Everything You Need to Know about Gold Loan Per Gram Rate

In Indian culture, gold holds huge significance and symbolises wealth and prosperity. Other than being considered auspicious, this precious metal is also one of the most popular investment avenues. An average Indian household keeps a major part of its savings in the form of gold ornaments, be it jewellery, coins, bars, or something else. The main reasons behind this are the lucrative ROI and easy liquidity that gold offers.

Table of Content

- What is Gold Loan Per Gram Rate?

- Impact of Per Gram Rate on Gold Loan Amount

- How to Maximize the Value of Your Gold Loan

This is a well-known fact that financial emergencies can come into everyone's life. Gold ornaments also serve as a reserve for those difficult situations. An individual can use his/her gold ornaments not only to create wealth over a period of time but also to get over a temporary cash crunch. Selling gold is not the only available option, as one can leverage gold ornaments to avail a loan as well.

The concept of borrowing money against gold ornaments is centuries old. Nothing much has changed over all these years. The only major difference is that things are more streamlined now, and traditional moneylenders have been replaced by government-authorised financial entities. Currently, there are a number of banks and NBFCs that offer quick and hassle-free gold loans. One can apply for a loan to quickly arrange the required sum of money and get over a financial crisis.

What is Gold Loan Per Gram Rate?

Also known as the gold loan price per gram, this value represents the loan amount one can get for every gram of gold. In other words, it is the amount a lender is willing to offer against one gram of gold.

There are two major factors that affect the gold loan per gram rate, which are:

- Gold Purity: This is one of the major considerations while determining the per gram rate for a gold loan. The purity of gold ornaments is measured in karats. If you are going to pledge gold ornaments with higher purity (22 karats or more), you'll get a better per gram rate while availing a gold loan.

- Current Market Rate: Another factor that affects the gold loan per gram rate is the current market rate of gold. When the price of gold rises, it will also lead to an increase in per gram value. Similarly, a drop in the market price of the metal results in a lower gold loan rate per gram. For example, if you want to get an idea about today's gold loan per gram rate, that can be calculated using the current market price.

Impact of Per Gram Rate on Gold Loan Amount

There are certain factors that affect the amount of a gold loan, with per gram value being one of them. It is directly proportional to the loan amount a borrower can obtain. Here is how the loan amount is calculated using the per gram rate:

For example, if you have 10 grams of 22-karat gold and the per gram rate is INR 5000, the total market value of your gold ornaments will be INR 50,000. Now the loan amount can be calculated using the prevalent LTV ratio. If the LTV ratio is 75%, you can borrow up to INR 37,500 by pledging your gold ornaments.

Suggested Read: 6 Ways Gold Loan Rate per Gram Shape Your Gold Loan Experience

How to Maximize the Value of Your Gold Loan

Now that you know how the per gram rate affects the loan amount you're eligible for, the next question arises: how to maximise it. Here are a few tips that you can use:

- Pledge High Purity Gold: Since gold purity is one of the key determinants for gold loan per gram rate, it is always best to pledge ornaments with higher purity. This way, you'll be able to get a better value for your ornaments.

- Use Unembellished Ornaments: When you apply for a loan against your gold ornaments, it is best to avoid using the ones with fewer stones. The reason behind this is simple: most lending institutions don't consider the weight of embellishments at the time of gold valuation.

There is no denying that a gold loan is one of the easiest financing options. Are you also planning to apply for a gold loan to deal with a financial emergency? If yes, this is where your search ends. Muthoot Finance gives you the option to avail a loan against gold ornaments at competitive rates of interest. You can use our online gold loan calculator to check the interest rate and the loan amount you're eligible for. Alternatively, visit your nearest Muthoot Finance branch to know more.

- Avail gold loan

- Calculate Gold Loan

- Check Gold rate today

- Gold Loan Eligibility

- Interest Rate

- Gold Loan Scheme

- Custom Offers

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Why Are Gold Loans the Best Option When Banks Reject Your Personal Loan?

Know More

Struggling with low CIBIL? Here’s How a Gold Loan Can Still Get You Funded

Know More

What is a Top-Up Loan? Eligibility Criteria Explained

Know More

Top Factors That Influence Mortgage Loan Interest Rates

Know More

What is a Loan Against Mutual Funds and How Does it Work?

Know More

What is Working Capital? Meaning, Formula & Importance

Know More

Understanding KDM Gold and Why it’s Banned

Know More

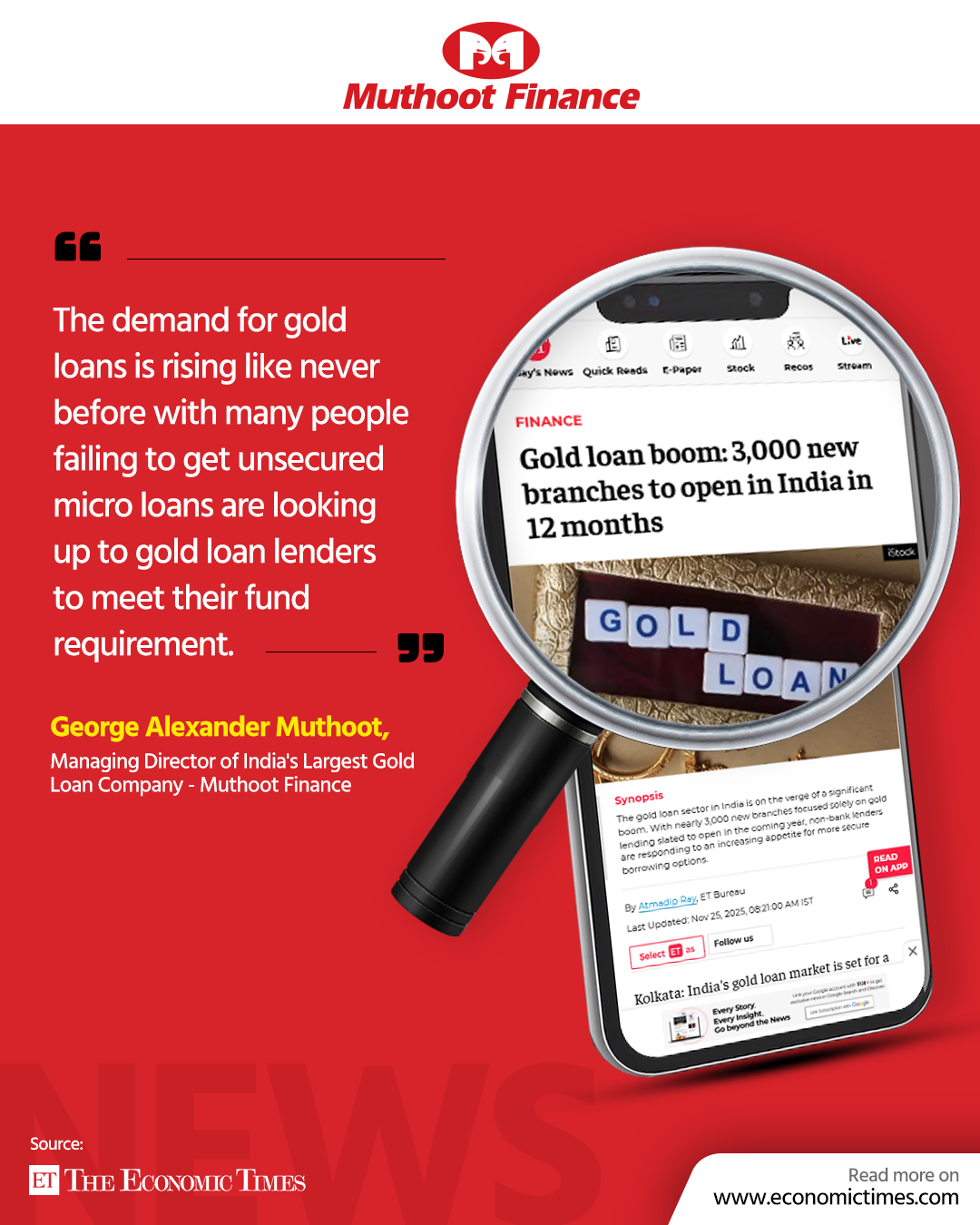

Gold loan boom: 3,000 new branches to open in India in 12 months

Know More

Gold Loan Boom: Rs 14.5 lakh crore market spurs NBFCs to add 3,000 branches

Know More

How BNPL Affects Your Credit Score

Know MoreFIN SHORTS

What Are Co-Pay and Deductibles in Insurance Policies?

Know More

Should You Take a Loan Against Your Mutual Fund or SIP?

Know More

Top 5 Best Mid-Cap Mutual Funds to Watch in 2026

Know More

Are Personal Loans Right for Retirees? Key Points to Consider

Know More

What Happens to a Personal Loan After the Borrower Dies?

Know More

Best Loan Choices for Credit Scores of 580 and Below

Know More

7 Reasons Why a Gold Loan Is the Best Option for Small Businesses

Know More

10 Reasons Why People in India Prefer Physical Gold

Know More

Real Estate vs Gold: Which Is a Better Investment in India?

Know More

10 Common Mistakes That Make Investors Lose Money in Mutual Funds

Know More

10 Reasons Why Gold Has So Much Appeal in Uncertain Times

Know More

7 Ways Settling Debt Can Impact Your CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212