Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

How to Choose the Best Car Insurance: Tips for Making Informed Decisions

Owning a car can bring convenience, independence, and a significant lifestyle change. Having a reliable mode of transportation is essential in unexpected situations. However, amidst the excitement of owning a car, it is crucial to remember that car insurance is a vital aspect that shouldn't be overlooked. If you're looking to buy car insurance, choosing the best policy can be a challenging task. With numerous options available in the market, it's essential to make an informed decision to ensure you get the coverage you need at a fair price.

Here are some tips on how to choose the right car insurance:

Understand the Types of Car Insurance

When you set out to find the best car insurance policy in India, it's important to understand the different types of car insurance available: -

Third-Party Insurance: This is the minimum coverage required by law. It covers damage to third-party property and injuries caused to others in an accident.

Comprehensive Insurance: This provides more extensive coverage, including protection for your vehicle, damage due to natural disasters, theft, and other perils.

Add-Ons: These are optional extras you can add to your policy for enhanced coverage, such as zero depreciation, roadside assistance, and engine protection.

Determine Your Coverage Needs

Think about your specific requirements before choosing a car insurance plan. Consider factors such as:

Vehicle Value: If you own a new or expensive car, comprehensive coverage might be more suitable.

Usage: If you use your car frequently, consider getting add-ons like roadside assistance.

Driving Environment: If you drive in a city or an area prone to natural disasters, additional coverage for damages may be beneficial.

Compare Quotes

Comparing quotes from multiple insurance providers is crucial when buying car insurance. Here's how to do it:

Use Online Comparison Tools: Several websites offer tools to compare quotes from different insurers based on your requirements.

Request Quotes from Multiple Providers: Contact insurance companies directly and request quotes. This will give you a better idea of what each offers.

Review Policy Features and Exclusions

When evaluating different insurance plans, consider the policy features and exclusions:

Coverage: Look at what the policy covers, including any additional benefits such as personal accident cover.

Exclusions: Understand what the policy does not cover, such as driving under the influence, mechanical breakdowns, or certain types of damage.

Assess the Insurer's Reputation

The reputation of the insurer is another critical factor to consider when choosing the best car insurance policy. Look for:

Claims Settlement Ratio: This indicates the insurer's track record of settling claims promptly and efficiently.

Customer Reviews: Read reviews from other policyholders to get an idea of their experiences with the insurer.

Check the Premium Cost

While it's important to choose a policy that provides adequate coverage, it's also essential to consider the premium cost:

Compare Premiums: Look at the premium for different plans with similar coverage options.

Check for Discounts: Some insurers offer discounts for safety features in your car, a good driving record, or bundling policies.

Understand the Claim Process

Before making a final decision, familiarize yourself with the claim process for each policy. Look for:

Ease of Claims: Check how easy it is to file a claim and the average turnaround time for claims to be processed.

Cashless Facilities: Find out if the insurer has tie-ups with garages for cashless settlements.

Car Insurance Renewal

Renewing your car insurance on time is crucial to maintain coverage. Here's what to consider during renewal:

Review Your Coverage: Assess your current policy and coverage needs to see if any adjustments are necessary.

Check for Better Options: Take the time to compare other plans and insurers to ensure you're still getting the best deal.

Choosing the best car insurance policy requires careful consideration of your needs and the available options. Don't forget to review your policy periodically, especially during car insurance renewal, to make sure it still meets your needs. At Muthoot Finance, you will get easy access to vehicle insurance, seamless claims processing, cashless services, and a user-friendly app for easy tracking.

- Insurance

- Group Insurance

- Health Insurance

- Home Insurance

- Vehicle Insurance

- Life Insurance

- Travel Insurance

- Shop Insurance

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

5 DIFFERENT WAYS OF REPAYING YOUR GOLD LOAN

Know More

What Is the Difference Between Pledge, Hypothecation and Mortgage?

Know More

Getting a Personal Loan Online with a 700 Credit Score

Know More

Personal Loan for NRIs in India – Documentation & Procedures

Know More

HOW TO GET PERSONAL LOAN WITHOUT CIBIL AND INCOME PROOF

Know More

Understanding E-KYC: Meaning, Process & Benefits

Know More

Why Credit Appraisal Matters Before Loan Approval

Know More

What Is an Emergency Loan? Everything You Need to Know

Know More

How Much Gold Can You Legally Keep at Home in India

Know More

Everything You Need To Know About Debt Management

Know MoreFIN SHORTS

4 Reasons Gold Loans Are Popular in South India

Know More

Top 5 Mutual Funds Giving Highest Returns in July 2025

Know More

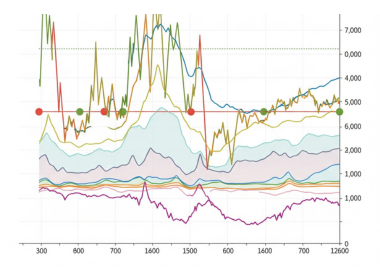

How to Read Muthoot Finance Share Price Trends Daily?

Know More

Share Price Today: Key Factors Influencing Stock Market Movement

Know More

Top Performing Mutual Fund Categories in 2025

Know More

Why Gold Loans Doubled in 2025: Insights

Know More

Top 5 Reasons to Monitor Gold Rate Daily

Know More

4 Impact of Repo Rate Cut on Personal Loan Interest Rates

Know More

Top 5 Best Performing Mutual Funds in 2025

Know More

5 Factors that affect gold loan processing time

Know More

Relation Between Personal Loan and Your CIBIL Score

Know More

Step-by-Step Way to Get Your First CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212