Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

How Personal Loans Can Ease Your Onam 2025 Expenses

Onam is the grand festival of Kerala; a time filled with joy, elaborate feasts, family gatherings, and vibrant celebrations. Yet, the costs of purchasing traditional clothes, preparing sumptuous meals, sending gifts, and arranging decorations can quickly add up. Managing all these festive expenses without financial strain becomes challenging, especially when cash flow needs to last through the season.

Table of Content

- Why Opt for a Personal Loan During Onam?

- Festival Planning with Personal Loans by Muthoot Finance

- Planning Your Onam: Smart Loan Applications

- Reference Table: Why Muthoot’s Personal Loans Fit the Onam Season

That’s where a well-timed instant personal loan can help you celebrate Onam with peace of mind. For example, Muthoot Finance, known for its trusted credit services, offers swift access to funds with minimal documentation. Their festive loan solutions are well-suited to bridge temporary financial gaps, ensuring you can honour every tradition without compromising on quality.

Why Opt for a Personal Loan During Onam?

Flexible Funds for Festivities

Right from the ingredients of an Onam sadhya to dazzling floral rangolis and presents for loved ones, the monetary demands are never-ending. A personal loan allows for the necessary flexibility in order to handle these unexpected expenses with ease.

Fast and Convenient Disbursal

Festivals demand quick planning. With instant personal loan options, you can get timely funds without standing in long bank queues.

Transparent and Affordable Rates

You can budget effectively when you know the personal loan interest rate in advance. Muthoot Finance gives attractive interest rates from 14% p.a. based on the credit score range and the loan tenor.

Manageable Equated Monthly Instalments (EMIs)

Steady monthly payments mean better preparation for balance following the festival. Use online tools like Muthoot’s personal loan EMI calculator to calculate EMIs that match your income and expense levels.

Festival Planning with Personal Loans by Muthoot Finance

During Onam, you might need to balance multiple costs from decor, traditional attire, feast provisions, and travel plans. A personal loan from Muthoot Finance is structured to meet such seasonal cash flow needs:

Least Documentation and Fast Processing

Apply without hassle; only income or identity proof is needed. It is about getting quick money to people and especially now when the festival season is in full swing.

Good range of Tenure Option

With an amount of ₹50,000 as the minimum loan, payback over the maximum tenure of 5 years is made so that you can space out payment of interest and principal amount over the years.

Smart Planning Tool

Our online personal loan EMI calculator is an extremely useful tool during Onam as it helps you arrive at repayments by factorising in loan amount, interest rate, and tenure - thereby helping you better manage your finances.

Planning Your Onam: Smart Loan Applications

Here’s a pragmatic approach to applying for a personal loan to fund your Onam celebrations:

Estimate Your Total Festive Spend:

Consider all costs - shopping, gifts, food, decoration, and travel.

Check Your Eligibility:

Ensure a good credit score and review Muthoot’s minimum income and documentation requirements.

Calculate EMIs:

Use the personal loan EMI tool to plan budget-friendly paybacks.

Apply and Get Funds:

With an instant personal loan, money is disbursed quickly.

Maintain Savings Discipline:

Reserve part of your festive budget for repayments, to enjoy guilt-free celebrations.

Suggested Read: Fastest Ways to Get a Personal Loan Approval

Reference Table: Why Muthoot’s Personal Loans Fit the Onam Season

Illustration | Description |

Ease of Process | Minimal documentation, quick disbursal |

Affordability via EMI Planning | Use tools like personal loan EMI calculator for neat budgeting |

Flexibility in Tenure | Borrow ₹50,000+ with up to 5 years to repay |

Aligned with Festive Needs | Instant funds when needed, without dipping into savings |

Onam 2025 could be a time of revival, tradition and making joyful memories and not budgeting stress. The reason is that you can celebrate every custom right from the grand Onam sadhya to the gift you thoughtfully picked with the help of personalized services by Muthoot Finance, without putting your hard-earned money at risk. A convenient financing plan allows you to have an amazing celebration while preserving the health of your wallet.

- Instant Personal Loan

- EMI Calculator

- Document Required

- Track Personal Loan

- Interest Rate

- Procedure and Eligibility

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Difference Between Primary Security and Collateral Security in Business Loan

Know More

Why Durga Puja 2025 Is the Best Time to Take a Vehicle Loan?

Know More

7 Reasons to Take a Gold Loan This Dussehra 2025

Know More

8 Perfect Financial Gifts for Your Sister on Bhai Dooj 2025

Know More

Make Your Dream Vehicle a Reality This Diwali 2025 With a Loan

Know More

Top Reasons to Begin a SIP This Festive Season 2025

Know More

7 Reasons Personal Loan is the Best Way to Manage Diwali 2025 Expenses

Know More

Manage Navratri 2025 Shopping & Travel with a Personal Loan

Know More

Term Loan Explained: Types, Features, Pros & Cons

Know More

Top 7 Benefits of Taking a Loan This Festive Season 2025

Know MoreFIN SHORTS

Difference Between Personal Loan and Consumer Durable Loan

Know More

Checklist Before Applying for Gold Loan Online

Know More

5 Steps To Get Your Business Ready For An Sme Loan

Know More

5 Solid Reasons To Choose Sip Over Fixed Deposits

Know More

5 Best Mutual Fund For Retirement 2025

Know More

Are Commercial Vehicle Loans Beneficial?

Know More

Why Digital Gold Loans Are Gaining Traction in 2025

Know More

Gold Price Forecast for the Next 6 Months

Know More

Why Travel Is Now the Top Reason for Indians to Take Personal Loans

Know More

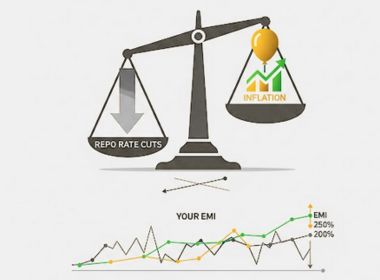

Repo Rate Cuts, Inflation, and Your EMI: Navigating Personal Loans in 2025

Know More

A ₹10,000 SIP Could Turn into Crores?

Know More

NPS Repairs: 6 Big Reforms Everyone Should Know

Know More- South +91 99469 01212

- North 1800 313 1212