Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Study Abroad with Ease: How a Personal Loan Can Fund Your Dream?

Going abroad for studies is a sure way to open up a range of personal and professional growth opportunities for yourself. However, not every student is able to afford the high tuition and living costs associated with studying abroad. In such cases, a personal loan can be a viable option to finance your dreams and start your new journey abroad.

Table of Content

- Benefits of Using Personal Loan for Abroad Studies

- Why Choose a Personal Loan Over an Education Loan?

- How to Get a Personal Loan for Abroad Studies?

- Conclusion

A personal loan, often referred to as a consumer loan, is an unsecured loan that does not require any kind of security, collateral, or guarantor. Lenders usually check personal loan eligibility based on your income, credit score, repayment ability, and financial history. Plus, the repayment period starts months after you take out the loan, giving you time to settle into your studies and adjust to a new environment.

Here is how a personal or consumer loan can be the bridge that connects your educational goals with your dream of studying abroad:

Need Funds Now? Get Your Personal Loan Approved Quickly

Benefits of Using Personal Loan for Abroad Studies

All Expenses Covered

A personal loan will not only be used to finance your education but can also be utilized to cover other living expenses, such as books, laptops, travel, housing, and health insurance. This flexibility will allow you to manage your expenses more effectively.

Adjustable Loan Tenure and Amount

These loans give you the flexibility to choose the loan amount and repayment tenure based on your budget, total expenses, and repayment capacity. You can also use an online personal loan calculator to get an estimate of monthly EMIs, allowing you to choose a loan term with EMIs you can comfortably afford.

Easy Online Application

The application process for these unsecured loans is quite simple, with most lenders offering online applications. You can complete the entire process from the comfort of your home without having to visit the lender's office

Quick Disbursal

Due to technology, the entire process of applying for a personal loan online is simplified, resulting in quick disbursement of loans. Additionally, the lack of collateral required in these loans makes the application process faster.

Minimum Documentation

These loans typically require less documentation compared to other types of loans, making the application process more convenient and efficient. You just need documents like proof of identity, proof of residence, income proof, salary slips, and employment certificate for one continuous year to avail of the loan.

Why Choose a Personal Loan Over an Education Loan?

Here are some reasons why a personal loan is a better option than an education loan: -

Personal loans offer significant lexibility as they can be used for various purposes beyond just educational expenses. In contrast, education loans are strictly for educational expenses such as tuition fees In education loans, the lenders may shortlist the best colleges and universities, and grade them according to their reputation. Chances are you may not qualify for a loan to study abroad if your university or college is ot on the lenders' list of institutions. Additionally, some lenders also look into a student's academic history before approving the education loan for abroad studies Personal loans are generally unsecured, meaning borrowers d not need to provide collateral like property or savings. Educational loans, however, often require a guarantor or collateral, which can complicate the borrowing process

How to Get a Personal Loan for Abroad Studies?

If you are confused about how to get a personal loan for abroad studies, here is a step-by-step process:

Prepare a Budget

Start by outlining your total expenses, including tuition fees, accommodation, living costs, travel, and other related expenses. This will help you determine how much you need to borrow and ensure you do not take on more debt than necessary.

Look for a Reputable Lender

Research various lenders to find one that offers personal loans with lower interest rates and favourable terms. Consider banks, non-banking financial companies (NBFCs), and online lenders. Check their reputation by reading reviews and comparing their offerings.

Ensure Your Eligibility

Ensure your personal loan eligibility by checking the eligibility criteria set by lenders, which often include factors such as credit score, income, employment status, and age. Meeting these requirements will increase your chances of approval.

Decide the Loan Length and How Much You'll Have to Pay

Choose a loan tenure that suits your financial situation. A longer tenure may lower your monthly payments but increase the total interest paid. You can also consider using an online personal loan calculator to get an estimate of monthly EMIs and understand how different tenures affect your repayments.

Create an Application

Gather the necessary documents and apply for the loan. Most lenders allow online applications, making the process quicker and more convenient.

Get to Work

Once you have your funds, start booking your tickets, pay your tuition fees, and get ready to start your exciting journey abroad.

Overall, a personal loan can be an excellent solution for students seeking to finance their education abroad, as it covers not just tuition but also accommodation and living expenses.

Need Funds Now? Get Your Personal Loan Approved Quickly

Conclusion

If you are looking for a personal loan to fund your dream to study abroad, then consider Muthoot Finance. Offering personal loans with lower interest rates, easy documentation, hassle-free documentation, and fast disbursal, Muthoot Finance is a brand you can trust. To apply for a personal loan, visit our website or your nearest Muthoot Finance branch.

- Instant Personal Loan

- EMI Calculator

- Document Required

- Track Personal Loan

- Interest Rate

- Procedure and Eligibility

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Differences Between Loans and Bonds

Know More

MCLR vs EBLR - Which One Saves More on Home Loans?

Know More

SIP vs SIF Fund: Meaning, Differences and Best Mutual Fund Option

Know More

Mudra Loan vs MSME Loan: Key Differences Every Small Business Owner Must Know

Know More

Daily SIP vs Monthly SIP: Which is Better?

Know More

How to Invest in NPS: Step-by-Step Guide for Beginners

Know More

Deferred Payment Meaning, Examples & How It Works in Personal Loans?

Know More

Gold Price Hits Record High: What It Means for Your Gold Loan?

Know More

Difference Between NPS and Mutual Funds

Know More

Difference Between Primary Security and Collateral Security in Business Loan

Know MoreFIN SHORTS

Difference Between Personal Loan and Consumer Durable Loan

Know More

Checklist Before Applying for Gold Loan Online

Know More

5 Steps To Get Your Business Ready For An Sme Loan

Know More

5 Solid Reasons To Choose Sip Over Fixed Deposits

Know More

5 Best Mutual Fund For Retirement 2025

Know More

Are Commercial Vehicle Loans Beneficial?

Know More

Why Digital Gold Loans Are Gaining Traction in 2025

Know More

Gold Price Forecast for the Next 6 Months

Know More

Why Travel Is Now the Top Reason for Indians to Take Personal Loans

Know More

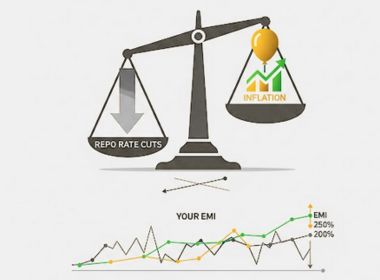

Repo Rate Cuts, Inflation, and Your EMI: Navigating Personal Loans in 2025

Know More

A ₹10,000 SIP Could Turn into Crores?

Know More

NPS Repairs: 6 Big Reforms Everyone Should Know

Know More- South +91 99469 01212

- North 1800 313 1212