Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Top Uses of a PAN Card: A Comprehensive Guide

The world is going digital and in today’s times, the PAN card has become one of the most important documents to have in India. Whether an individual or a legal entity, a Permanent Account Number (PAN) card from the Income Tax Department of India is mandatory. Keeping tabs on financial transactions, tax payments, returns, transfers, credit card purchases, etc. of individuals, businesses, and legal bodies is what the PAN card is used for by the Income Tax Department. However, today, the PAN card has several other purposes as well.

Table of Content

PAN Card: An Explanation

PAN is a unique 10-digit identification number that is issued by the Income Tax Department to all taxpayers in India. The PAN is an electronic system for recording all tax-related information about a person or entity against a single permanent account number. The PAN acts as an identity proof of an individual or entity and no two taxpayers can have the same PAN.

On 1 January 2017, the Income Tax Department introduced a new PAN card format to include a Quick Response, or QR code, which carries the cardholder's details. One use of the PAN card QR code is to verify the cardholder's data. Today, it is very easy to apply for a PAN card online as well. Whether you are applying for a new or an amended PAN card, a small amount of money will be charged for receiving a physical card.

The PAN card issue date is not highly relevant, but it is always a good idea to know where it is located on the card. The date of issue is placed vertically at the bottom right of the card. The format for the date is DDMMYYY.

Top Uses of a PAN Card

The PAN card has several essential uses in India, primarily for tax-related activities, like conducting financial transactions above a specified limit, filing income tax returns, buying or selling real estate, etc. If you do not have one, you can apply PAN card online with ease. Here is more on the various uses of PAN cards:

Starting a Business

As per the norms established by the Government of India, PAN is necessary for every business established in the country. Additionally, a company is also required to have a TRN (Tax Registration Number) to be able to trade and file tax returns. Most e-commerce platforms also require that companies have a TRN to be able to sell products through their platform. A TRN can only be obtained by a company if they have a PAN.

Tax Deductions

One of the top reasons why you should have a PAN is for taxation purposes. If a person has annual interest earnings that exceed Rs 10,000 on their savings deposits, they must have their PAN linked to their bank account. The reason behind this is that if an account does not have a PAN linked to it, the bank in question will start deducting TDS at 30%, instead of the 10% that would have been applicable if the PAN was linked.

Opening a Bank Account or Demat Account

In India, an individual will not be able to open a new bank account if they do not have a PAN. For individuals who want to open a bank account or a Demat account, they must apply for a PAN card online. However, there is also one exception to this norm. As per the Prime Minister Jan Dhan Yojana, a PAN will not be required if an individual opens a zero-balance account. In this situation, the individual can use their voter ID card or ration card as proof of identity.

Filing Income Tax Returns

The PAN is a mandatory requirement for any and all tax-related activities, including filing income tax returns. The PAN serves as a unique identification of the taxpayers in the country. It also helps the government keep track of financial transactions to ensure that taxpayers are paying the right amount of tax. This helps ensure that there are no transactions that cannot be traced, which helps curb instances of tax evasion.

Suggested Read: Why Your Pan Card Is Crucial For Filing Income Tax Returns?

Making Investments or Buying RBI Bonds or Insurance

Before you can put your money into investment avenues, like mutual funds, you are required to fill out a form, which is available on the official website of the Association of Mutual Funds in India (AMFI). Along with the form, you will also be required to attach an address proof as well as a self-attested copy of your PAN card. Your application for investing will only be accepted if you are KYC compliant and have a PAN card. In the same way, the PAN card will also be required to invest in RBI bonds amounting to Rs 50,000 or more.

Forex

Any transaction that involves foreign currency is categorised as a current account transaction. Under the Foreign Management Act, a PAN card is mandatory for purchasing or selling foreign currency that amounts up to Rs 50,000 or more.

Listed or Unlisted Securities Transactions

Under the Securities Contracts (Regulation) Act 1956, having a PAN card is mandatory for the purchase of securities, both listed and unlisted. This rule excludes debentures, shares, bonds, and other marketable securities. However, it is applicable if the amount involved in a transaction is more than Rs 1 lakh. A PAN card is also mandatory for buying or selling the shares of an unlisted company, valued at more than Rs 1 lakh.

Suggested Read: Know The Benefits And Importance Of Having A Pan Card

A PAN card is also required for buying or selling immovable property, buying or selling a four-wheeler, applying for a loan, buying jewellery priced above Rs 5 lakh, getting a new phone connection, making cash deposits of more than Rs 50,000, and opting for banker’s cheques, pay orders, and bank drafts of more than Rs 50,000. An important thing that you should remember is that it is never safe to give your PAN number online to anyone.

- Apply PAN Card Online

- Application

- Eligibility

- Documents Required Forms

- Form 49A

- Form 49AA

- Fees

- Correction & Update

- NRI PAN Card

- Tracking

- Penalty

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Why Are Gold Loans the Best Option When Banks Reject Your Personal Loan?

Know More

Struggling with low CIBIL? Here’s How a Gold Loan Can Still Get You Funded

Know More

What is a Top-Up Loan? Eligibility Criteria Explained

Know More

Top Factors That Influence Mortgage Loan Interest Rates

Know More

What is a Loan Against Mutual Funds and How Does it Work?

Know More

What is Working Capital? Meaning, Formula & Importance

Know More

Understanding KDM Gold and Why it’s Banned

Know More

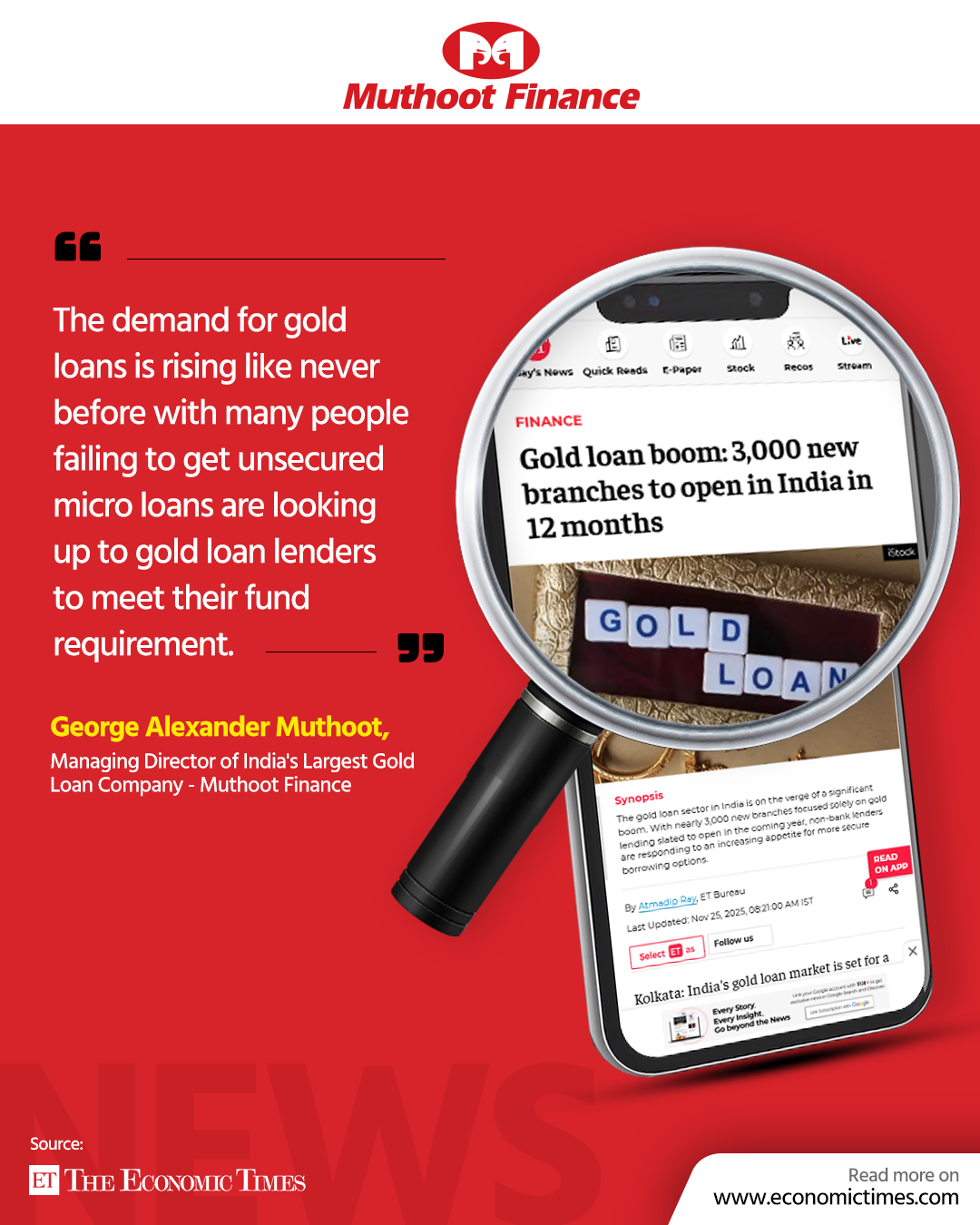

Gold loan boom: 3,000 new branches to open in India in 12 months

Know More

Gold Loan Boom: Rs 14.5 lakh crore market spurs NBFCs to add 3,000 branches

Know More

How BNPL Affects Your Credit Score

Know MoreFIN SHORTS

What Are Co-Pay and Deductibles in Insurance Policies?

Know More

Should You Take a Loan Against Your Mutual Fund or SIP?

Know More

Top 5 Best Mid-Cap Mutual Funds to Watch in 2026

Know More

Are Personal Loans Right for Retirees? Key Points to Consider

Know More

What Happens to a Personal Loan After the Borrower Dies?

Know More

Best Loan Choices for Credit Scores of 580 and Below

Know More

7 Reasons Why a Gold Loan Is the Best Option for Small Businesses

Know More

10 Reasons Why People in India Prefer Physical Gold

Know More

Real Estate vs Gold: Which Is a Better Investment in India?

Know More

10 Common Mistakes That Make Investors Lose Money in Mutual Funds

Know More

10 Reasons Why Gold Has So Much Appeal in Uncertain Times

Know More

7 Ways Settling Debt Can Impact Your CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212