Search Suggestions

- Gold Loan

- Money Transfer

- Mutual Funds

Why a Longer Repayment Personal Loan is a Must-Have Choice for Everyone?

Instant personal loans available online are versatile loans that can be used for a variety of purposes. It could be for a medical emergency, a wedding, a new gadget, or for a vacation. It is not always possible to come up with collateral to avail of a loan against it. Or, there isn’t enough time to go through a lengthy secured loan process to get the desired funds. It is when an instant personal loan comes to the rescue.

Things to Know Before Applying for a Personal Loan

A Personal Loan application can get approved instantly when other eligibility criteria are met. However, you should evaluate other parameters associated with the loan to ensure that you do not default on the EMIs of the Personal Loan.

Before you decide to apply for a personal loan, do keep the following points in mind:

- Purpose of the Loan: Personal loans charge some of the highest interest rates in the industry. Ask yourself why you want to get a personal loan. Is it for something that can be avoided or postponed?

- Eligibility Criteria: Most lenders are wary of lending to customers with a credit score of less than 750. A low credit score implies below-average credit management and thus low creditworthiness. Use the Personal Loan Eligibility Calculator on the lender’s website to evaluate your eligibility.

- Interest Rate Comparison: Personal loan interest rates offered by different lenders could vary. The EMI of a Personal Loan is directly affected by the interest rate. Make sure to do detailed research to get the lowest possible interest rate on the Personal Loan.

- Repayment Evaluation: It is crucial to evaluate your financial condition, including other financial obligations, thoroughly. You must ensure that your income is enough to cover the personal loan EMIs. An online Personal Loan EMI Calculator can help you get an estimate of the monthly installments you need to pay for a particular loan amount, tenure, and interest rate.

Should you opt for a longer tenure in Personal Loans?

When you apply for a Personal Loan, you have the option of choosing the repayment tenure for the Personal Loan. The tenure of your loan will have a direct bearing on the monthly EMIs, so choose wisely. A Personal Loan Repayment Calculator gives you an idea about the repayment schedule, interest, and EMI according to the tenure you choose.

The advantages of longer repayment tenure on a personal loan are as follows:

- Lower EMIs: Longer the tenure of the Personal Loan Repayment, the lower will be the Personal Loan EMI amount. In addition to your other monthly financial obligations, a smaller EMI could reduce your financial burden and stress. The estimated EMI amount according to the tenure and interest rate can be calculated on the Personal Loan EMI Calculator.

- Higher Principal Amount: When you choose a longer tenure for your loan, your EMI automatically drops. Depending upon your financial needs and affordability, a longer Personal Loan repayment tenure allows you to borrow a higher loan amount, based on your debt-to-income ratio.

- Improves your Credit Score: When you select a tenure based on your financial capacity, you should be able to easily repay the loan on time. A good repayment history can help improve your credit score. A good credit score is an important parameter to have if you need to avail of a loan in the future.

- Option to Prepay: Rather than spending a big portion of your income on servicing Personal Loan EMIs, you can utilize the money elsewhere. Also, whenever you have surplus cash, you could prepay a part of your loan after the lock-in period is over.

Who Should Opt for a Long-Duration Personal Loan?

Opting for a longer tenure Personal Loan repayment might not be ideal for everyone. It is best suited for someone who has many financial obligations in a month and a lower Personal Loan EMI could reduce his/her monthly financial burden. Or, if a borrower is already repaying other high-interest loans such as credit card dues, a longer repayment tenure and hence a lower EMI amount allows him/her to divert cash toward paying them off first. It is important to choose the tenure carefully when applying for an instant Personal Loan.

- Instant Personal Loan

- EMI Calculator

- Document Required

- Track Personal Loan

- Interest Rate

- Procedure and Eligibility

CATEGORIES

OUR SERVICES

-

Credit Score

-

Gold Loan

-

Personal Loan

-

Cibil Score

-

Vehicle Loan

-

Small Business Loan

-

Money Transfer

-

Insurance

-

Mutual Funds

-

SME Loan

-

Corporate Loan

-

NCD

-

PAN Card

-

NPS

-

Custom Offers

-

Digital & Cashless

-

Milligram Rewards

-

Bank Mapping

-

Housing Finance

-

#Big Business Loan

-

#Gold Loan Mela

-

#Kholiye Khushiyon Ki Tijori

-

#Gold Loan At Home

-

#Sunherisoch

RECENT POSTS

Why Are Gold Loans the Best Option When Banks Reject Your Personal Loan?

Know More

Struggling with low CIBIL? Here’s How a Gold Loan Can Still Get You Funded

Know More

What is a Top-Up Loan? Eligibility Criteria Explained

Know More

Top Factors That Influence Mortgage Loan Interest Rates

Know More

What is a Loan Against Mutual Funds and How Does it Work?

Know More

What is Working Capital? Meaning, Formula & Importance

Know More

Understanding KDM Gold and Why it’s Banned

Know More

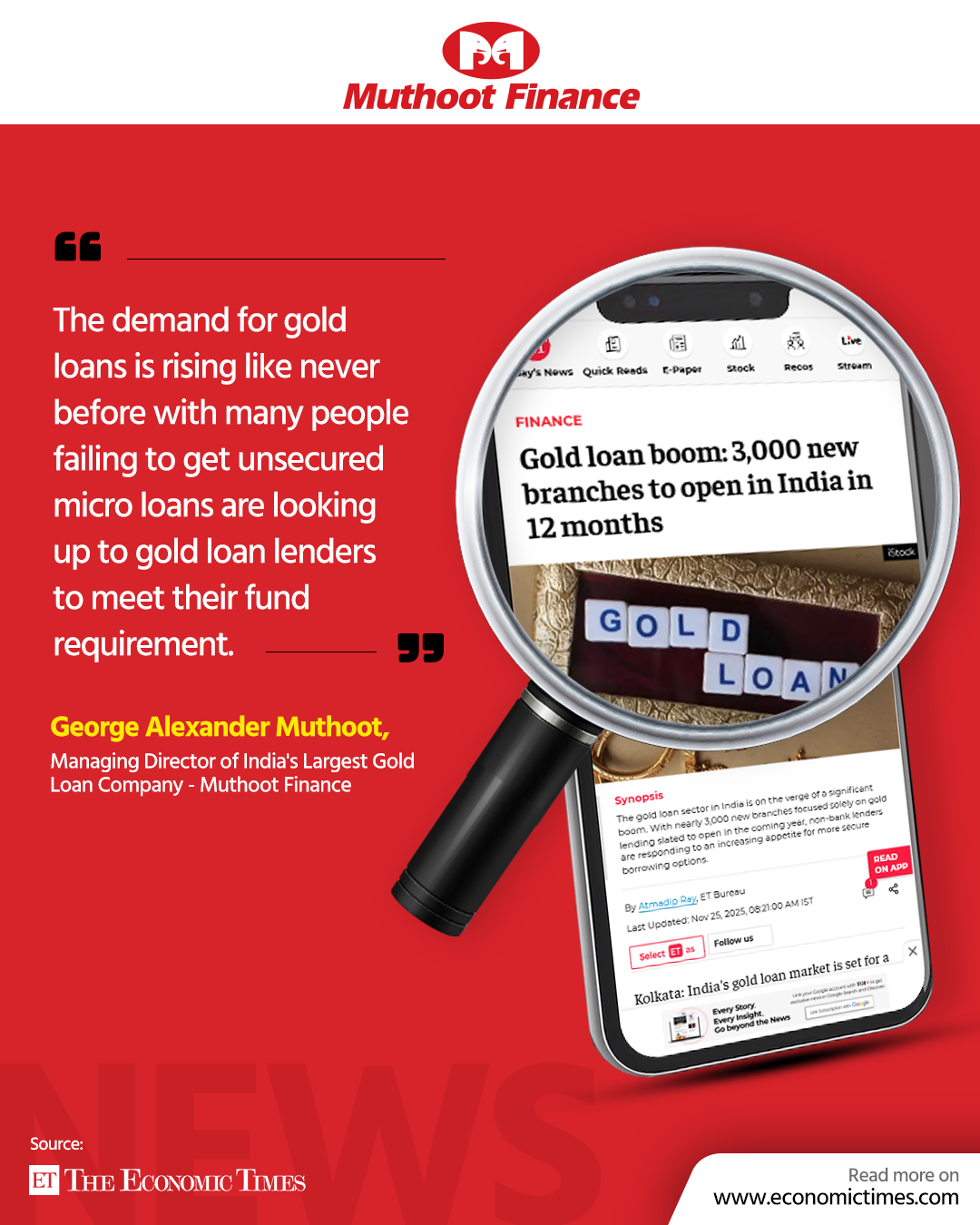

Gold loan boom: 3,000 new branches to open in India in 12 months

Know More

Gold Loan Boom: Rs 14.5 lakh crore market spurs NBFCs to add 3,000 branches

Know More

How BNPL Affects Your Credit Score

Know MoreFIN SHORTS

What Are Co-Pay and Deductibles in Insurance Policies?

Know More

Should You Take a Loan Against Your Mutual Fund or SIP?

Know More

Top 5 Best Mid-Cap Mutual Funds to Watch in 2026

Know More

Are Personal Loans Right for Retirees? Key Points to Consider

Know More

What Happens to a Personal Loan After the Borrower Dies?

Know More

Best Loan Choices for Credit Scores of 580 and Below

Know More

7 Reasons Why a Gold Loan Is the Best Option for Small Businesses

Know More

10 Reasons Why People in India Prefer Physical Gold

Know More

Real Estate vs Gold: Which Is a Better Investment in India?

Know More

10 Common Mistakes That Make Investors Lose Money in Mutual Funds

Know More

10 Reasons Why Gold Has So Much Appeal in Uncertain Times

Know More

7 Ways Settling Debt Can Impact Your CIBIL Score

Know More- South +91 99469 01212

- North 1800 313 1212